non filing of income tax return letter format

You deducted tax from any payment. Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1Add the taxable items and the non-allowable expenses listed on lines 101 to 199 and subtract from this the non-taxable items and.

Authorization Letter To File Income Tax Return Fill And Sign Printable Template Online Us Legal Forms

You have to fill out the T4A slip Statement of Pension Retirement Annuity and Other Income if you made any of the payments listed above and one of the following applies.

. 10- Income Tax Returns under Section 1395 of Income Tax Act 1961 can be revised when filed pursuant to notice under Section 148 as it is provided us 148 that for such return all the provisions of section 139 shall apply. They are liable to file the Income Tax Return in the prescribed format with required documentation. 2017-18 the penalty shall be 50.

You have to prepare a T4A slip for a subscriber if any RESP accumulated income payments. Unemployment compensation statements by mail or in a digital format or other government. DO NOT INCLUDE THE INITIAL 21 Each withholding account is provided with a PIN printed on the lower lefthand corner of your Form W3N.

File a joint state income tax return and you are liable for only your own share of state income tax. EFile your Income tax return online in minutes. MyITreturn ensures accurate efiling of ITR with maximum tax refund.

And Date of filing in ITR-34. From our home page click on theFilePay your Return select Income Tax Withholding E-filePay and log in to file the Form W-3N. This Kit will provide you with the information you need for your first tax filing process - from incorporation to the filing of the first Estimated Chargeable Income ECI and Form C-S Form C-S Lite Form C.

The total of all payments in the calendar year was more than 500. 11- You will have to cough up 100 to 300 per cent of tax due as penalty for concealing income WEF. After receiving all your wage and earnings statements Forms W-2 W-2G 1099-R 1099-MISC 1099-NEC etc.

Access the New Company Start-Up Kit an interactive e-Learning guide to learn more about your Corporate Income Tax filing obligations. In the following cases the filing of Income Tax Return is Voluntary. Specified tax return preparer members of recognized religious groups are exempt from the requirement to e-file if the religious group is conscientiously opposed to its members using electronic technology including for the filing of income tax returns electronically and the religious group has existed continuously since December 31 1950.

Changing tax regime. Make sure that the reason mentioned for non-filing should be genuine and it should be acceptable to the authorities. In case Taxpayer had already opted New Tax Regime last year and filed Form 10-IE for AY.

Preparing and filing your tax return. 2022-23 he is required to file Form 10-IE this year for opting out of the New Regime and mention the filed Form 10-IE Ack. GST Practitioners Association Punjab has requested Union Minister of Finance for Extension of Due date for filing of Income Tax Returns us1391 of Income Tax Act1961 for non-Audit category of assesses from 31st July 2022 to 31st August 2022Full text of their representation is as follows-GST PRACTITIONERS ASSOCIATION PUNJAB Ref.

If any individual or non-individual tax assessee has not filed tax returns within the specified deadline Section 139 also features the guidelines to file delayed returns. Login using your companys Nebraska ID Number. It prepares your return basis the information entered by you in the electronic format as needed by the.

2021-22 and Taxpayer wishes to opt out from the new tax regime for AY. Use Schedule 1 to reconcile the net income loss reported on your financial statements and the net income loss required for tax purposes.

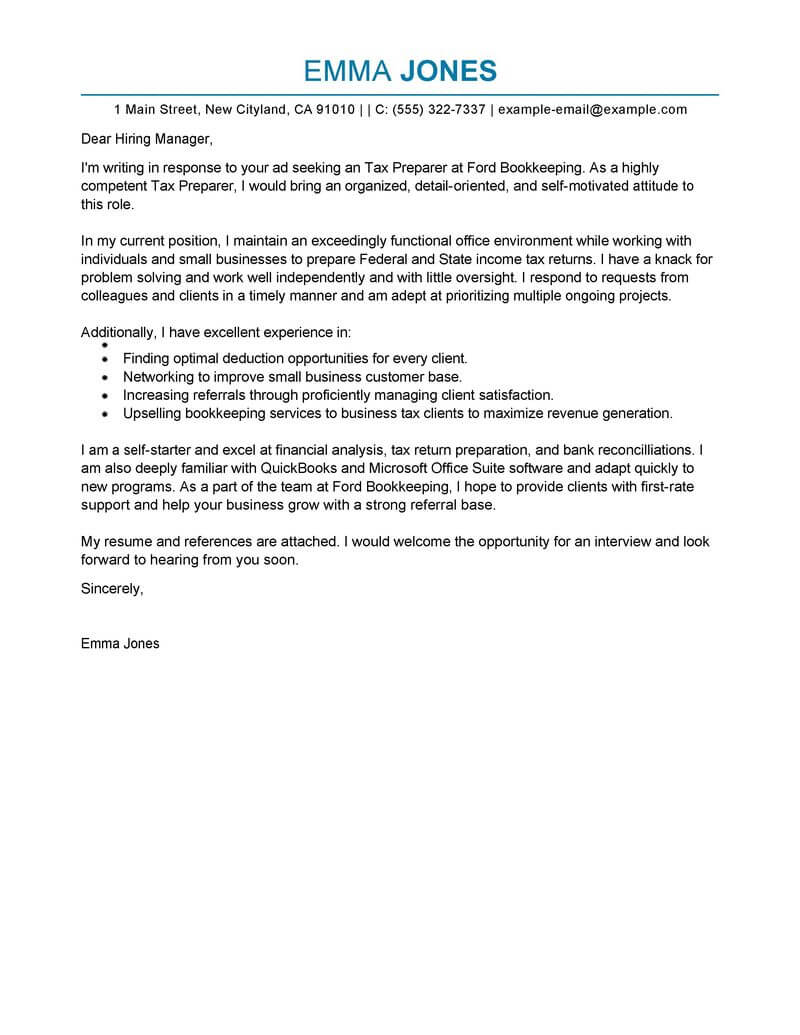

Income Tax Preparer Cover Letter Example Kickresume

Tax Return Cover Letter Sample 20 Guides Examples

Tax Services Accounting Finance Cover Letter Examples Kickresume

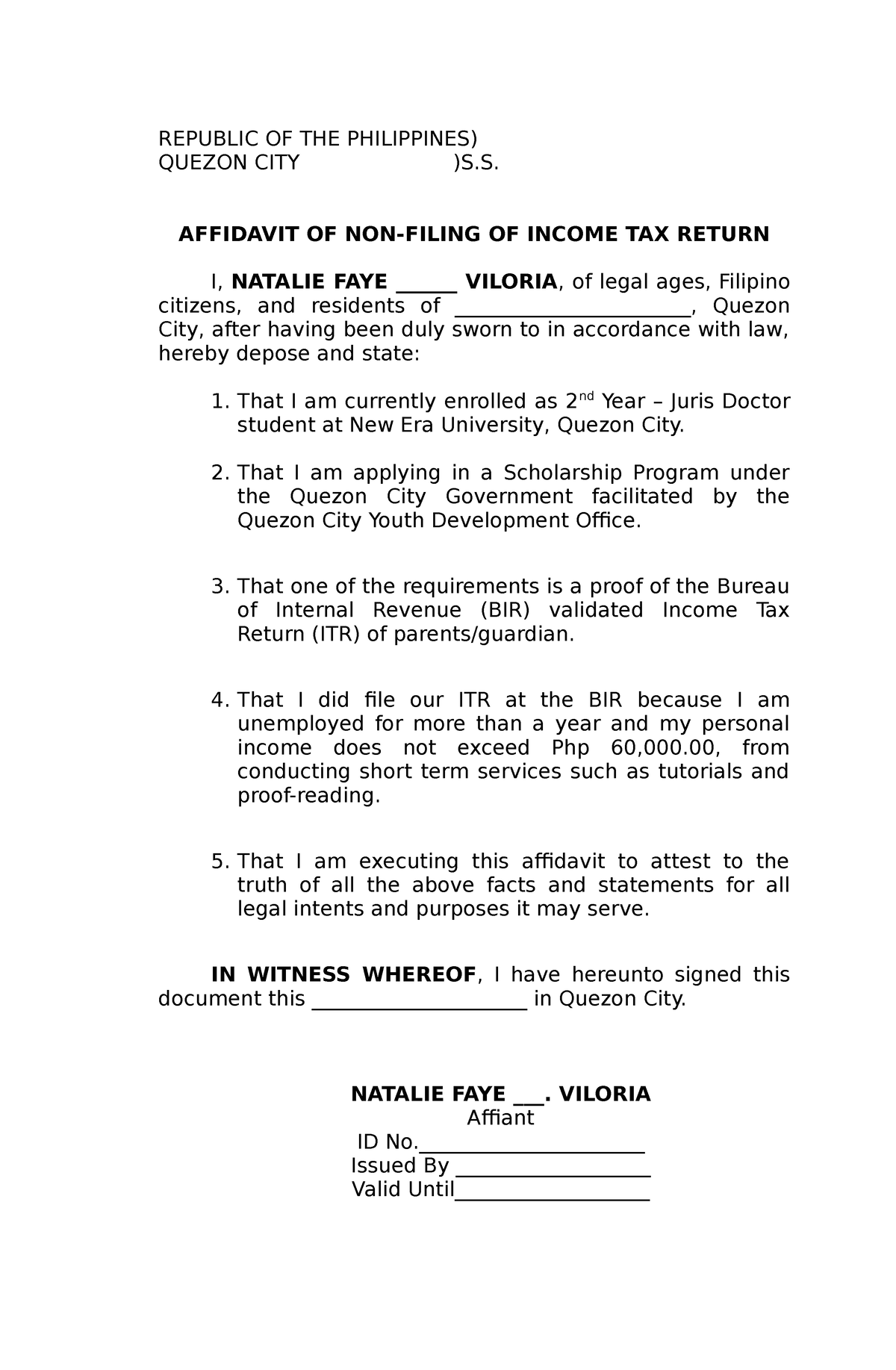

Affidavit Of Non Filing Of Income Tax Pdf Affidavit Payments

Tax Services Accounting Finance Cover Letter Examples Kickresume

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

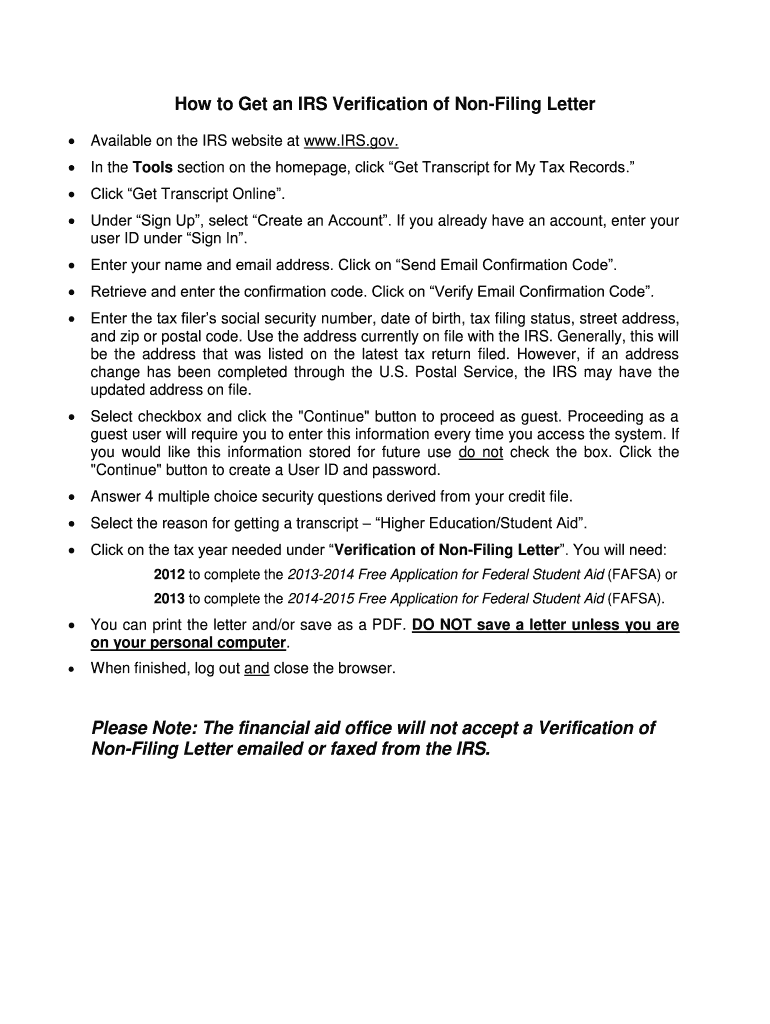

Verification Of Non Filing Letter Fill Online Printable Fillable Blank Pdffiller

Tax Preparer Cover Letter Examples Finance Livecareer

Tax Return Engagement Letter Pdf Templates Jotform

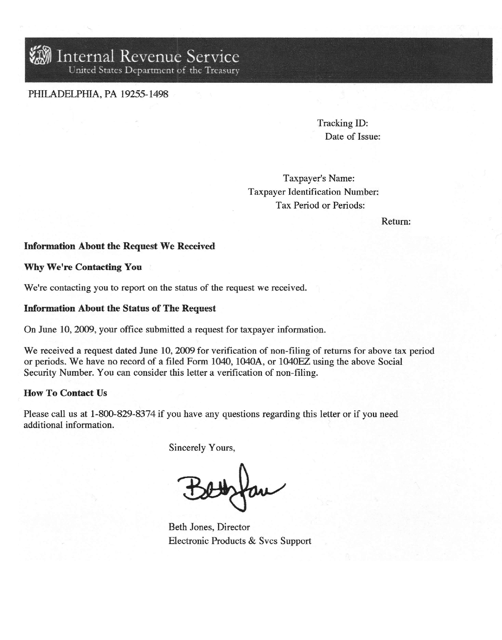

Irs Verification Of Non Filing Letter Download Printable Pdf Templateroller

Affidavit Of Non Filing Of Income Tax Pdf Affidavit Payments

Affidavit Of Non Filing Of Income Tax Republic Of The Philippines Quezon City S Affidavit Of Studocu

Affidavit Of Non Filing Of Income Tax Pdf Affidavit Payments

Sample Letter For Non Filing Of Income Tax Return Fill Online Printable Fillable Blank Pdffiller

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

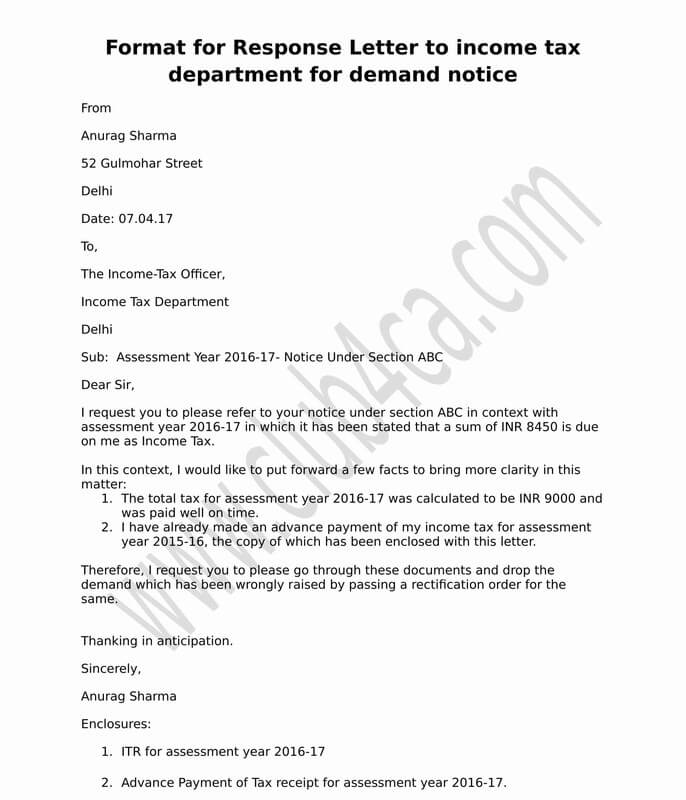

Letter Format To Income Tax Department For Demand Notice

Insert Dd Month Yyyy The Commissioner Inland Revenue Department Po Box 39010